The New Year is off to a rousing start for the U.S. stock market. With the recent stock bear market now definitively behind us and a new all-time high on the S&P 500 now in the books, it is reasonable to consider what are the most likely pain points that could dash the optimism for the U.S. stock market as we continue our way through 2024.

All about the money. When it comes to evaluating potential downside risks for the market at any given point in time, arguably the most reliable determinant to monitor for stock performance is liquidity. This can be measured in a variety of ways including money supply, bank lending activity, credit spreads, general speculative market activity, and the direction of monetary policy among many other factors. But if the liquidity environment remains abundant, the U.S. stock market can not only remain resilient but can seemingly defy logic to the upside. Conversely, if access to liquidity becomes more restricted, stocks can suffer beyond reasonable expectations even if underlying fundamentals become decidedly favorable.

Thus, when monitoring for downside risks, a key focus in the analysis is the potential impact on the liquidity environment for investors. For if investors have more liquidity than they know what to do with, it often needs to find a destination (read – risk assets at any price). Conversely, if investors don’t have the money, they can’t invest it (read – less demand for risk assets) and they may need to sell what they have to raise it (read – increased supply of risk assets needing to be sold).

This sharpens our focus on the key downside risks for the year ahead. In previous articles, I have already cited what I believe are the two biggest downside risks for capital markets in 2024, which are listed below.

- A renewed rise in inflation, thus leading to more restrictive monetary policy and a reduction in liquidity.

- Federal reserve rate cut expectations falling well short of expectations, thus leading investors to have less liquidity going forward than they have been anticipating in recent months.

- But recognizing that these downside risks are already well documented, it is worthwhile to consider additional risks to liquidity that may be getting less attention in the financial media today.

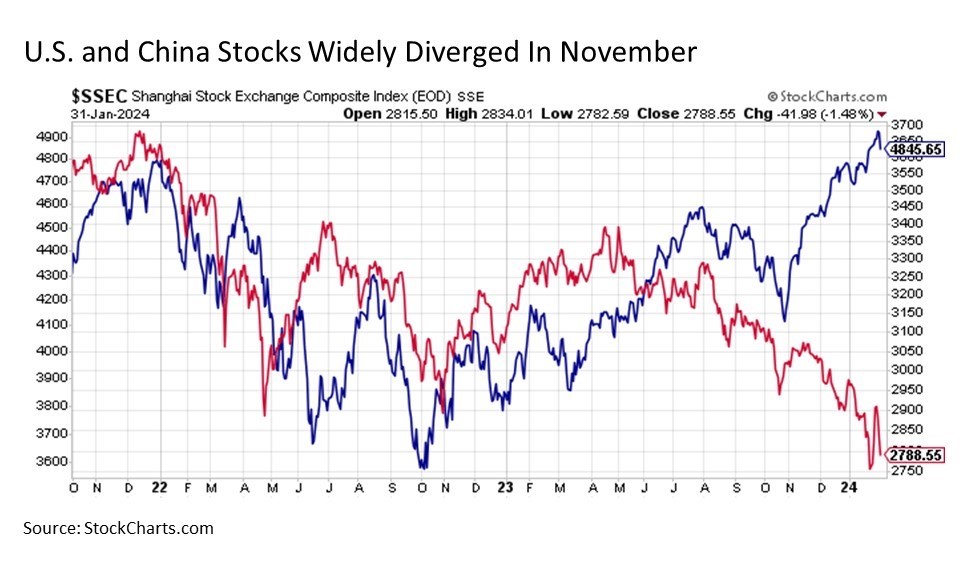

Seeing red. China is a major downside liquidity risk factor for monitoring in the year ahead. Although the magnitude is not what it used to be, the world’s second largest economy is still a massive source of holders of U.S. risk assets including Treasuries and stocks. And given that the beleaguered Chinese economy continues to cope with persistent economic weakness and an ongoing commercial real estate dilemma, it is worth monitoring developments out of China for potential bouts of liquidation that may take place in the coming year.

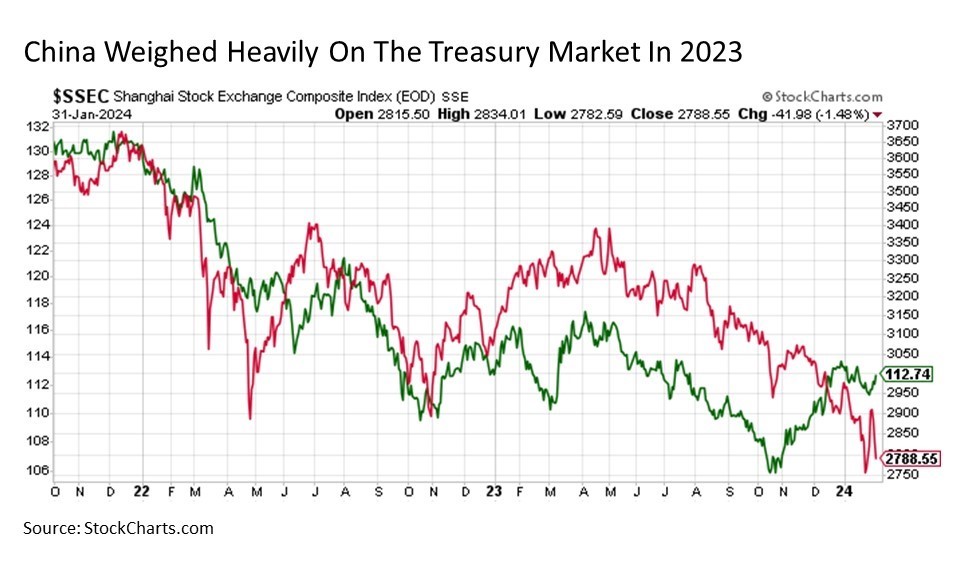

A reasonable metric to monitor in this regard is the performance of the Shanghai Stock Exchange Composite, which has plunged to new cycle lows since the start of the year. We already saw the impact that China liquidation along with a regulatory crackdown had on the U.S. Treasury market in 2023, so this is a risk that remains worth monitoring on the bond side for any renewed rise in Treasury yields.

The potential feedthrough effects from any China weakness have the potential to be even more pronounced on U.S. stocks, as they have largely shaken off any such pressures since November, but the risk remains that we could see a reconvergence in this relationship with U.S. stocks catching down toward China stocks.

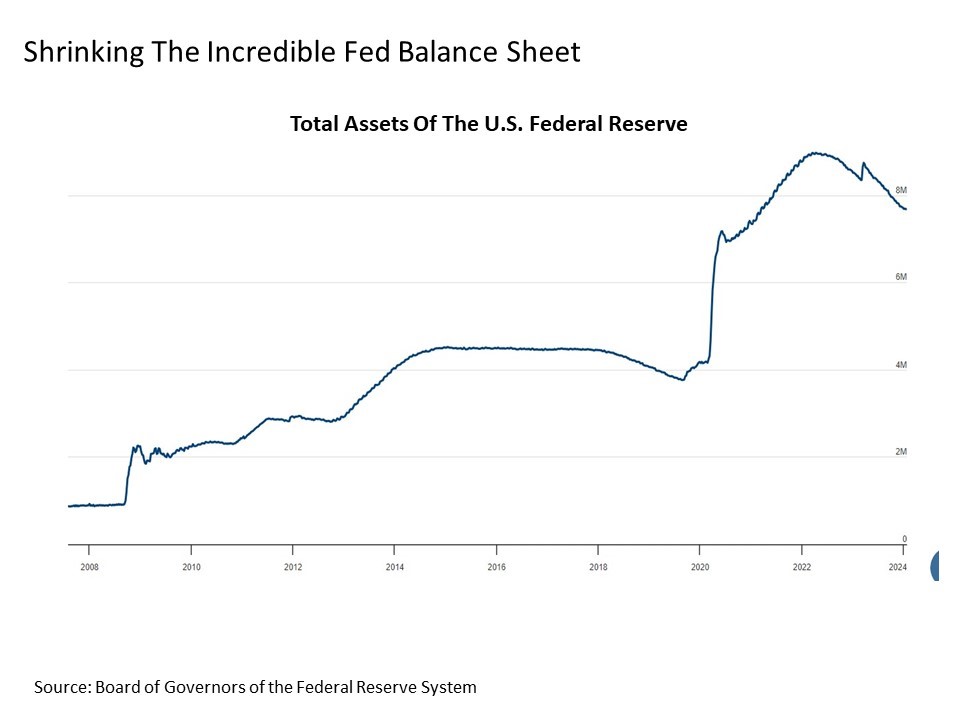

Hanging in the balance. Another potential source of liquidity drain is the U.S. Federal Reserve. Yes, the Fed is almost certainly done raising interest rates in the current cycle (barring that renewed inflation outbreak scenario mentioned above) and may be lowering interest rates as soon as March according to the most optimistic investors among us, both of which are liquidity positive. But the Fed has also been shrinking the assets on its balance sheet, which exploded beyond comprehension in the midst of the COVID crisis and remains heavily bloated versus where it was not just five years ago but even more so fifteen years ago since the Great Financial Crisis.

The shrinking of the Fed’s balance sheet is a liquidity drain for financial markets. Since peaking just short of $9 trillion in March 2022, the total assets of the Federal Reserve have dropped by more than $1 trillion. This is a meaningful balance sheet reduction that the markets have been able to withstand thus far, but this has been thanks in large part to government fiscal policy stimulus that to date has more than filled the liquidity gap. If these fiscal policy offsets to Fed balance sheet shrinkage dissipate in the months ahead for any number of reasons, the net decline in liquidity could start to have a hidden bite on risk asset prices.

Not so tiny bubbles. This last risk may seem counterintuitive at first. A third downside risk for capital markets in 2024 is an unexpectedly strong surge in asset prices that start to become unstable and require monetary policy intervention.

We have already seen a double-digit surge in the U.S. stock market since the end of October, and the S&P 500 is continuing to hover at the very high end of its trading range since the 2022 lows. In the process, many of the largest stocks in the U.S. marketplace are trading at premium normalized price-to-earnings ratios. Moreover, we also saw a mini AI bubble last summer, and if the liquidity environment becomes sufficiently supportive that asset prices start rising more uncontrollably to the upside, the Fed may be compelled to either withhold rate cuts or reverse course with rate hikes in order to rein in speculative activity. And while the trip up one side of the mountain may be euphoric, often the careening down the other side of the mountain of a bubble can be more disruptive on net, particularly if it is induced by a withdrawal of liquidity.

Bottom line. U.S. capital markets have proven highly rewarding for investors over the last few months, but downside risks remain. Monitoring for risks that may cause shifts in the liquidity environment remain important going forward in managing against the potential for downside risk in this still rising market.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 536328-1